News

Blue Prism Adds More Speed, Accuracy, Scale and Transparency of Decision-Making Capabilities to its Digital Workforce

Contact Us

A recent report by accountancy and advisory firm BDO suggested that the volume of reported fraud in hit a 15-year high, with a total value of fraud increasing 538% to £2.11Bn. Considering the impact of Covid-19, companies have had to alter the conventional ways of operation and adapt to a more online-centric business model.

Since the eCommerce sector is booming, it has given rise to an increase of fraudulent activities, and companies will be faced with the same problems as before, but on a greater scale. According to a Wall Street Journal report - the overall percentage of attempted fraudulent digital transactions rose 35% (in-terms of dollar volume) in April from a year earlier.

There are two main types of digital transactions that has seen an uptick in fraud recently:

To tackle these challenges companies must now look to new and innovative solutions to combat this rise in fraud across many sectors. One of the key focus areas is fraud detection/investigation:

The answer is Fraud Detection Automation.

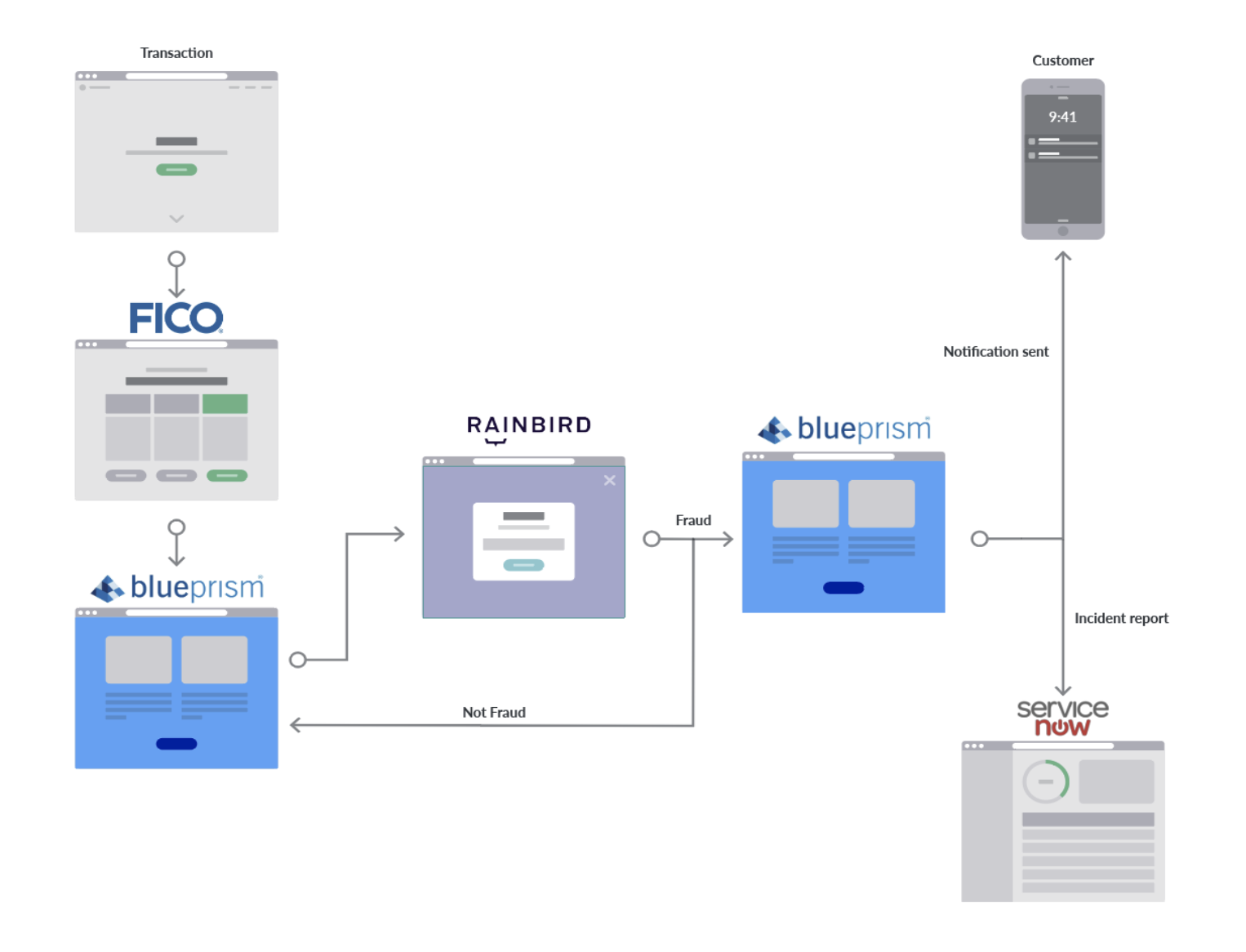

Blue Prism and Rainbird have collaborated on an fraud detection automation solution, which replicates the end-to-end fraud investigation process for major organisations - including data gathering, case decisioning, and follow-up action.

Fraud investigation processes are typically very manual, in particular for large banks and insurance businesses. They deal with a high and often unpredictable volume of cases which are increasing in complexity, and often involve hundreds of employees. Operational costs are high, and the quality and speed of response is often less than desired. Our fraud detection automation software can significantly reduce costs in year 1 by introducing unprecedented speed, accuracy and scalability. The solution is also fully auditable and explainable.

The fraud detection automation solution offered by Blue Prism and Rainbird can deliver multiple benefits.

The combination of RPA and AI augments the human decision-making process by providing rationale for every recommendation, which in turn acts as an audit trail for any automated decision-making. Thanks to our recent partnership with Rainbird, a Blue Prism Digital Worker can now refer to Rainbird to solve a problem and then act on the answer provided, without ever needing to refer to a human worker.

The Intelligent Fraud Investigation solution delivers an end-to-end automated fraud investigation process for major organisations - including data gathering, case decisioning and follow-up action, helping address and mitigate the growing challenge of monitoring and preventing sophisticated fraudulent activity, in this unprecedented time of economic impact from Covid-19.

For more information on how you can add automated fraud detection to your enterprise automation platform, please visit our Digital Exchange.

If your network blocks YouTube, you may not be able to view the video on this page. In this case, please use another device. Pressing play on the video will set third-party YouTube cookies. Please read our Cookies Policy for more information.